Stories

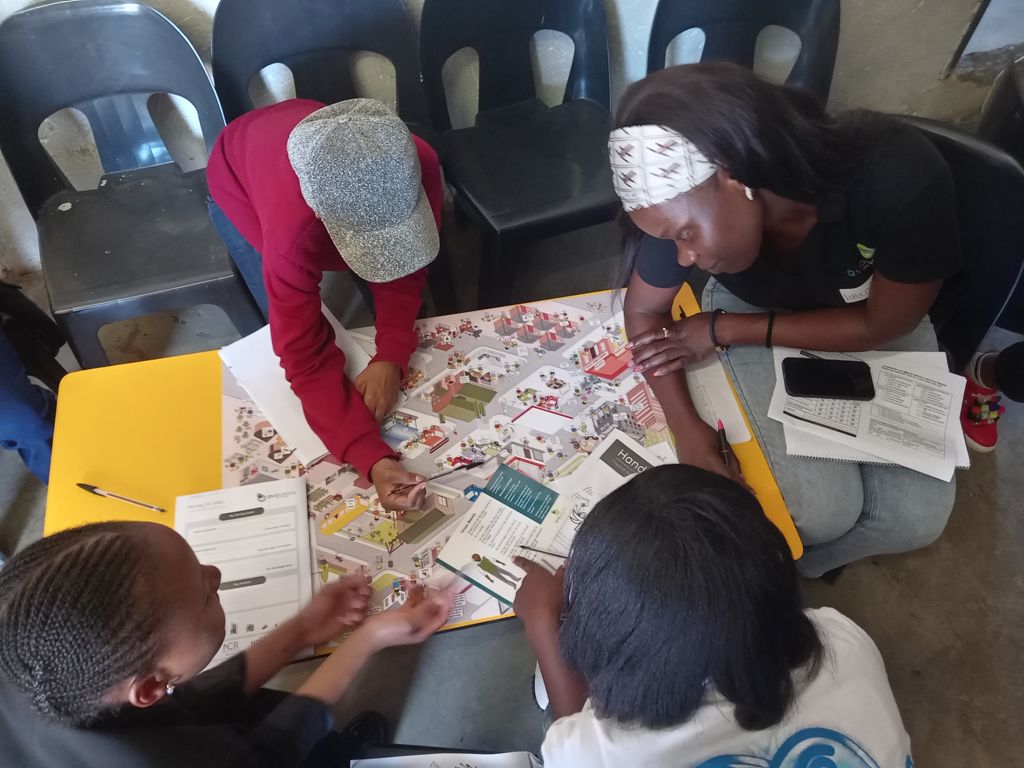

In the month of April, I had the privilege of facilitating six financial literacy sessions for the Mangaung community—reaching both the young and old. One session was held in an urban area, while the remaining five took place in rural communities, with a significant impact especially observed in Thaba Nchu. The financial literacy training made a meaningful difference in several key areas: 1. Empowerment through Knowledge: Participants gained crucial financial skills, including budgeting, saving, and introducing money concepts to children, equipping them to make better financial decisions. 2. Increased Confidence: Many attendees left the sessions feeling more confident in managing their personal finances and equipped to teach these skills within their families, laying a foundation for generational financial awareness. 3. Community Engagement: The positive feedback and requests for monthly sessions reflect the community’s appreciation and eagerness to continue learning. 4. Recognition and Motivation: Receiving certificates boosted morale and validated participants efforts, encouraging them to continue their financial learning journey. A heartfelt thank you to Avocado Vision for giving our people hope. Because of these sessions, individuals have learned how to budget, save, and spend wisely—reducing reliance on debt and fostering greater financial stability within our communities.

In the month of April, I had the privilege of facilitating six financial literacy sessions for the Mangaung community—reaching both the young and old. One session was held in an urban area, while the remaining five took place in rural communities, with a significant impact especially observed in Thaba Nchu. The financial literacy training made a meaningful difference in several key areas: 1. Empowerment through Knowledge: Participants gained crucial financial skills, including budgeting, saving, and introducing money concepts to children, equipping them to make better financial decisions. 2. Increased Confidence: Many attendees left the sessions feeling more confident in managing their personal finances and equipped to teach these skills within their families, laying a foundation for generational financial awareness. 3. Community Engagement: The positive feedback and requests for monthly sessions reflect the community’s appreciation and eagerness to continue learning. 4. Recognition and Motivation: Receiving certificates boosted morale and validated participants efforts, encouraging them to continue their financial learning journey. A heartfelt thank you to Avocado Vision for giving our people hope. Because of these sessions, individuals have learned how to budget, save, and spend wisely—reducing reliance on debt and fostering greater financial stability within our communities.

In the month of April, I had the privilege of facilitating six financial literacy sessions for the Mangaung community—reaching both the young and old. One session was held in an urban area, while the remaining five took place in rural communities, with a significant impact especially observed in Thaba Nchu. The financial literacy training made a meaningful difference in several key areas: 1. Empowerment through Knowledge: Participants gained crucial financial skills, including budgeting, saving, and introducing money concepts to children, equipping them to make better financial decisions. 2. Increased Confidence: Many attendees left the sessions feeling more confident in managing their personal finances and equipped to teach these skills within their families, laying a foundation for generational financial awareness. 3. Community Engagement: The positive feedback and requests for monthly sessions reflect the community’s appreciation and eagerness to continue learning. 4. Recognition and Motivation: Receiving certificates boosted morale and validated participants efforts, encouraging them to continue their financial learning journey. A heartfelt thank you to Avocado Vision for giving our people hope. Because of these sessions, individuals have learned how to budget, save, and spend wisely—reducing reliance on debt and fostering greater financial stability within our communities.

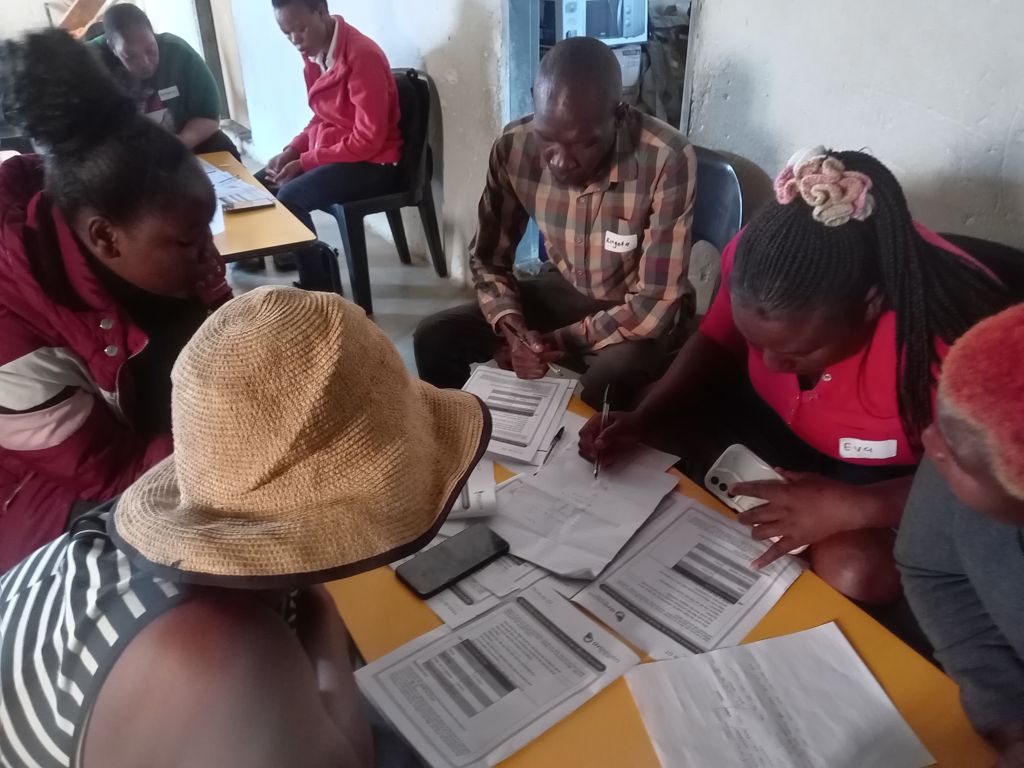

Had 3 ENRICHED MONEY fo sho's training with 2 community groups and 1 workplace, commenced with managing money by identifying financial goals for each individual as they shared their goals and dream and on that note they have learned that it does not require more money or richness to have financial goals and being able to save for them. What is important is to draw your budget and from income to expenses what is left is for one to save for a goal therefore that will direct you to know how much you saving and for how long categorising short, medium and long term goal so we all concluded it's all about discipline, realistic and consistent. We then proceeded to managing risks where by each group had 3 cards of different insurances and they role played the sales people selling insurance to others, furthermore discussed WILLS, accidents and claims. In addition we demonstrated buying in cash and in credit, shared the reasons why people buy on credit and how credit build credit record then some shared their situations and asked for ways to overcome risky situations. Lastly the financing funerals we discussed ways to prepare for such event, they listed policies, undertakers and community policies and we filled in the funeral forms acting as if we planning for one, then each shares their estimated costs and mostly said in disbelief that "funerals indeed are expensive" meaning they need to be prepared for financially. The session was productive and participants were willing to change their habits and practise financial control and discipline.

On the 07th of May 2025, I conducted training in Klawer in the Western Cape. We held multiple sessions at the venue, Money Module 2 (Savings and Investments) and Money Module 7 (Ageing Grace) modules were done. The participants were particularly interested in the savings and investment modules, expressing a lot of shock when we covered the Retail Savings Bonds portion of the Training. One participant, an elderly lady said she was interested in teaching her grandchildren about the savings options.

I got the privilege to conduct training with matjhabeng municipal employees who shared their different experiences when it comes to credit and savings. Gladys who has been in administration for the past 10 years shared how she ended been over indebted. She said when she started she took a lot of credit to renovate his parent's house,then some for clothing and furniture. But as time goes by she discovered that she can no longer afford her debts and a friend advised her to apply for administration of which she had no clue how this decision will affect her credit score and her life. She applied and her instalments were reStructure but she is blaming herself for taking her friend's advise cause she can't apply for credit due to that and her score doesn't allow her to apply for a house. She got the paid up letter but she still a red flag for administration that can only be cleared in 2027.

I did my Coronation sessions in KwaXimba,Number 9 area, at the sports centre,we had a Rocky start because the weather was very bad,it was raining heavily and the sports centre is next to the river, which most participants had to cross to get to the training.So we started later in the week,and the Trainees showed up in their numbers, proving a hunger for the information that we had brought for them.what stood out for me,was that most of them were young and fresh out of high school,looking for every opportunity to make their lives better.On the day that we did the Scams and fraud module,my learners shared different scam stories that they have seen or heard of and we shared information on how to recognize a scam,that afternoon when we left the session one of my learners was scammed and her cellphone was stolen. She said she met this guy walking on the road,carrying a backpack and wearing work clothes,He stopped her and asked her to please go and give his father his wallet because he is now late for work and he left with his father's wallet.He pointed at a house,claiming that's where he lives and that's where his father is waiting for the wallet.The guy then called his father and put him on loud speaker so that my learner can also prove that he is not lying,sure enough the father picks up and confirms he is waiting for the wallet.my learner then took the wallet and started walking towards the house,midway to the house,she puts her hands in her pockets to reach out for her phone,and the phone was gone.when she goes back to where she was with the guy,He was gone,she asked the people around if they saw the guy,they said he was picked up by a white polo vivo. Sad story indeed,but it was a confirmation of our session we had the day before,when she got to class, she was like "haybo Miss,yesterday we had a lesson on scams and I was scammed,these things are true "

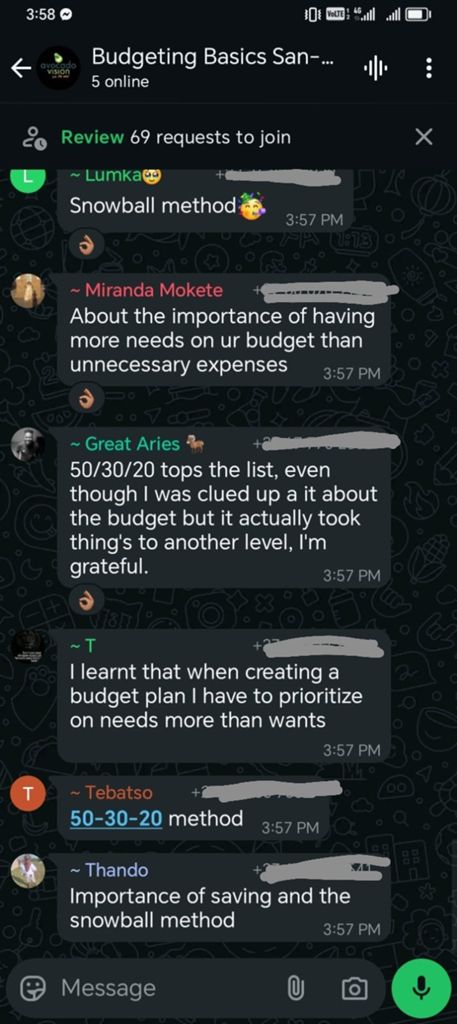

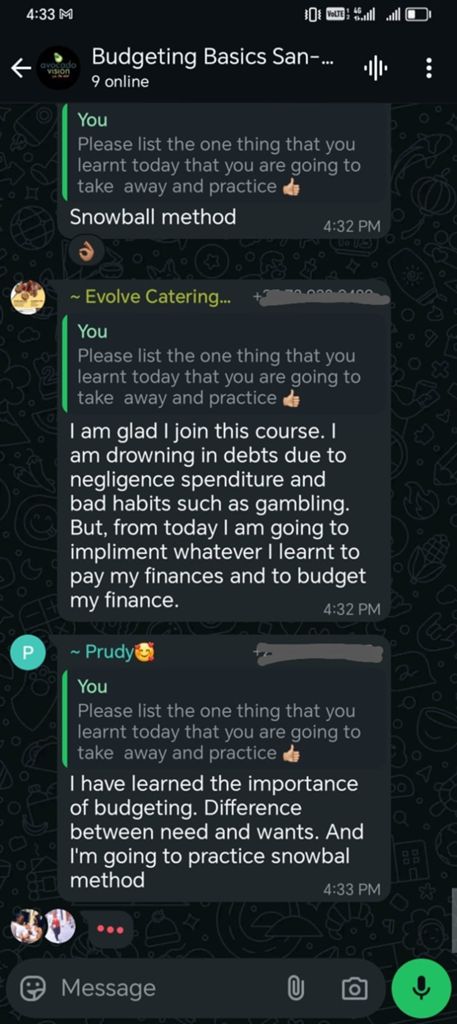

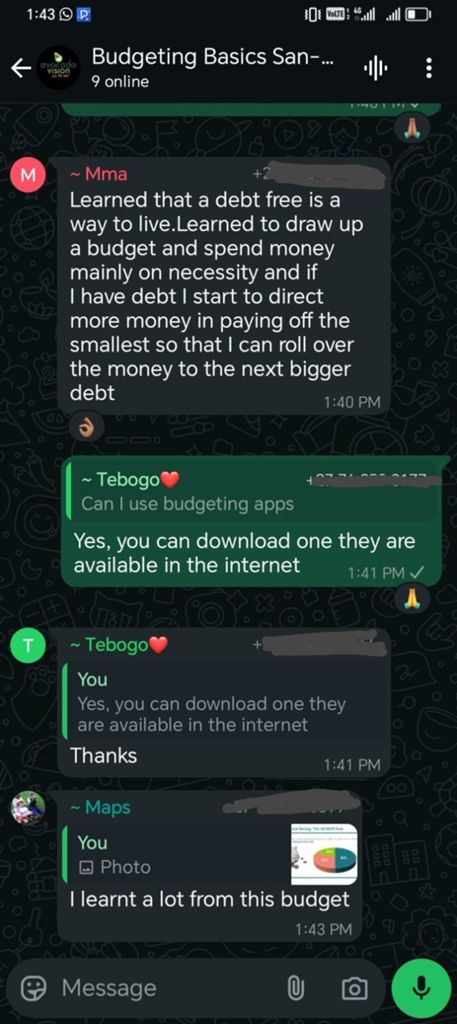

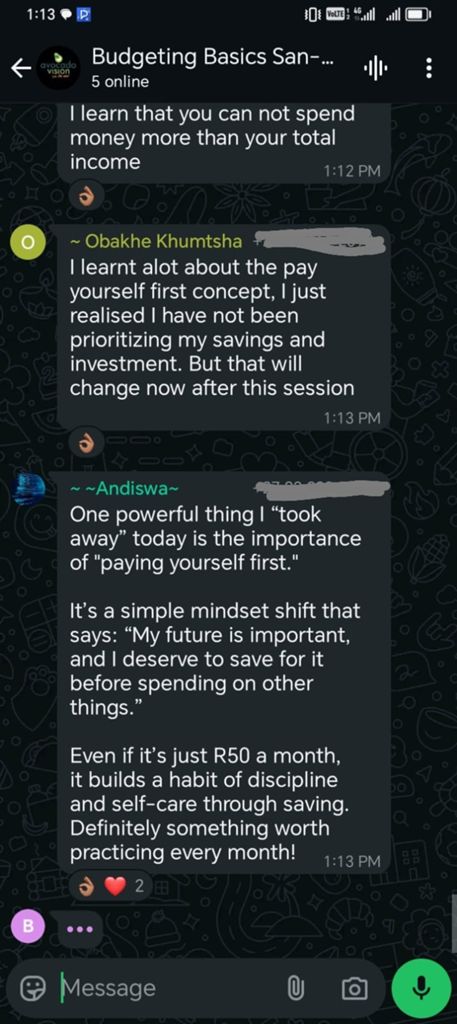

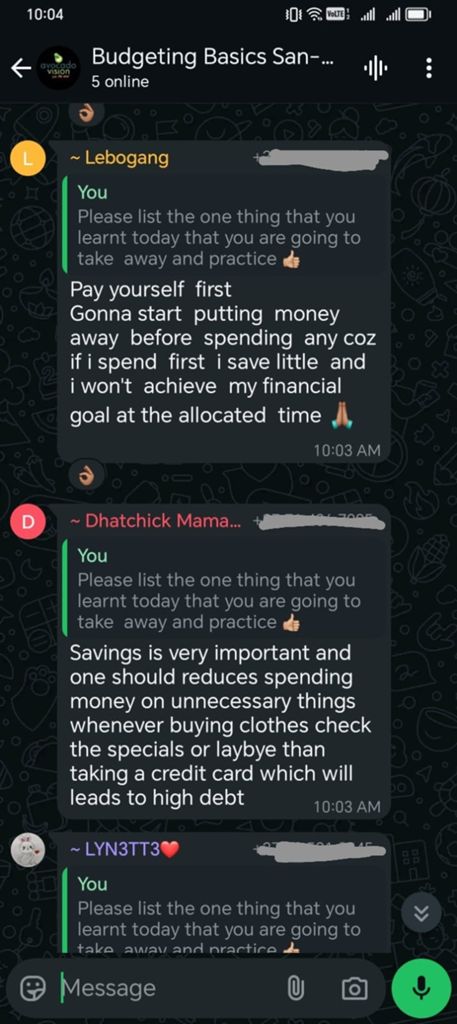

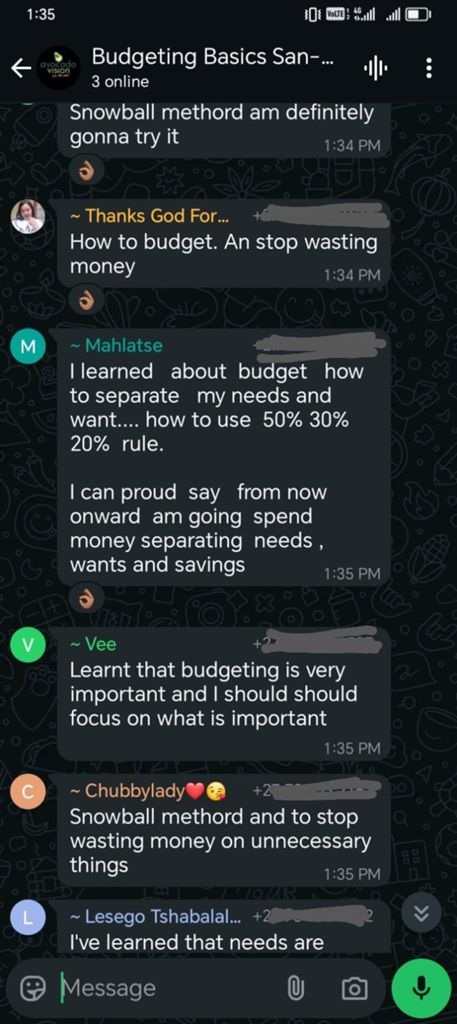

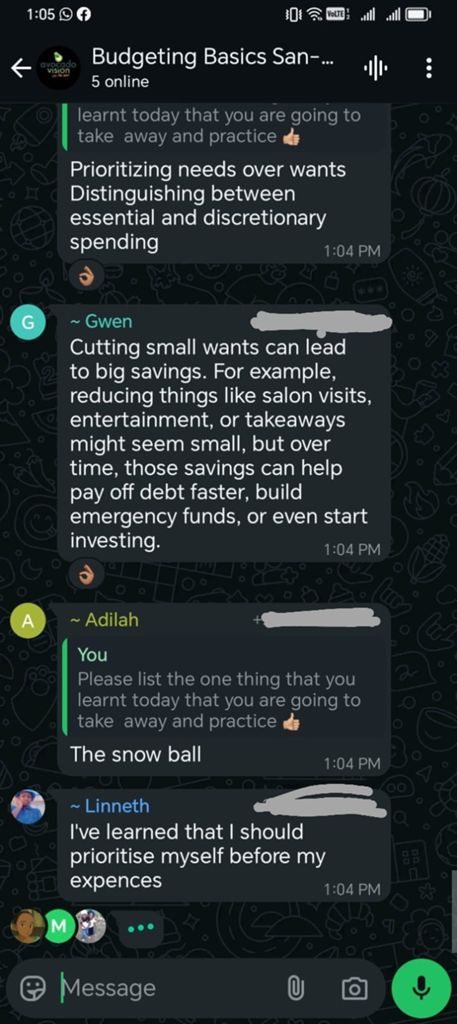

I had sessions on budgeting Basics Webinar, here is some feedback from the participants

I had sessions on Money Fo Sho with Cosmo City Community. They where very excited when they heard about the opportunity they where offered, they participated so well and shared some real stories on some of the topics. with the feedback i received the course will really help them manage their money better and deal with their debts.

The session on Money and Beliefs was scheduled for 25 April 2025. Ms Sharon Coetzee was one of the participants and indicated that this was truly an eye opener. She realized that she sometimes spent money because of some cultural belief that wasn't always necessary. She was now made aware that spending should rather be based on needs and not always wants.