Story

By Lindile Zanda Mpepanduku

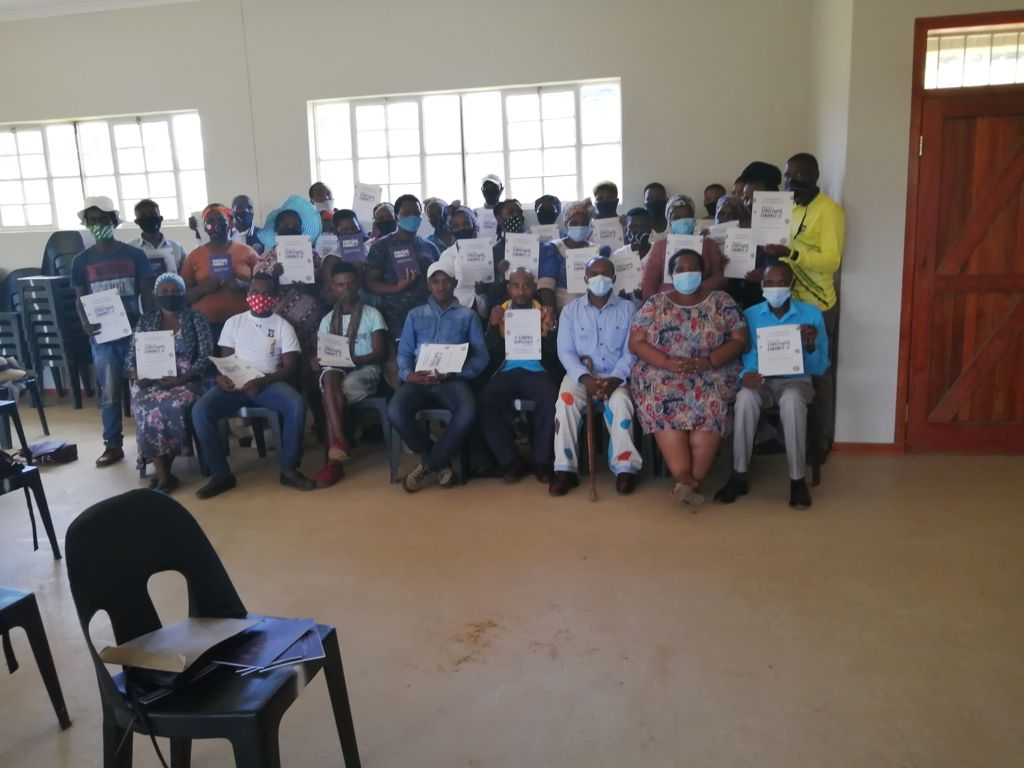

Hollard

Ever since I started facilitating Financial Literacy trainings I have always wished to know whether some Participants do practice any of the things we try to encourage them to do in order to start saving.

In one of the sessions I did this month, there was a lady by the name of Babalwa that came after the session, she was not part of the session as she was about to leave for her work shift. She told me that she had attended one of the Avo Trainings in 2014, she came to greet me and to thank you for teaching her the importance of starting to save from the little you have and that saving is not about starting with a lumpsum but you can start with even 10c. She started saving in 2015, she challenged herself to save the same amount of money that she gives her daughter daily when she goes to school, which is R5 a day which is R25 per week and R100 a month. After doing this for two years, her daughter joined in with her R5. so now they have their little club of savings and deposit it in a Post Bank Account. This money she is saving for when her daughter leaves for Varsity in 2022.

They currently have a savings of R8000, they have had to use some of the money that they had saved last year during lockdown. Had she not started saving earlier, she would have had no money to keep them going during the tough lockdown period.

My motivation now is that, we are doing these trainings to plant a seed, be it that of saving, learning to prioritize our spending according to our needs, the importance of having a will or that of investing for the future/retirement but plant that seed, one or two people will listen and will make the right decisions for their kids and families. Change is always 1 person at a time, we have not only changed the life of Babalwa but her daughter will make informed decisions from here on and teach the same to her kids.